Author: Jean Chen, Robert Mao

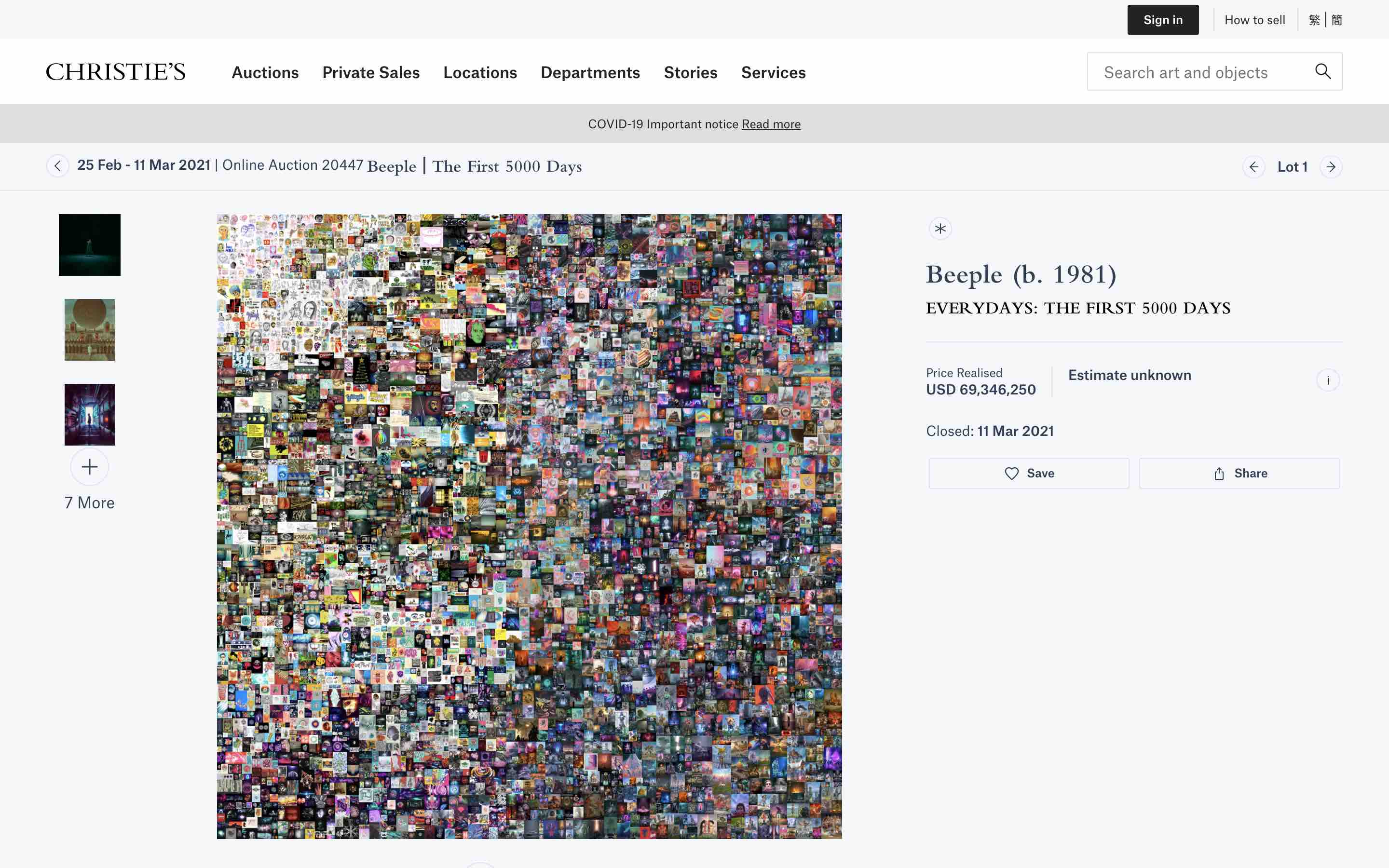

NFT is the most exciting new hotspot in the blockchain industry/cryptocurrency market nowadays: a digital artwork called Everyday's - The First 5000 Days fetched $69.34 million at Christie's, making Beeple the third most valuable living artist; The NFT of the first tweet by Jack Dorsey, the Twitter founder, sold for $2.9 million; NBA Top Shot, the NFT project that offers a digital trading cards of moments of NBA players such as LeBron James, generated record over \$400 million in sales. More artists, players, stars, celebrities, and sports leagues, manga companies, and media outlets are flocking into the market to produce and sell NFTs; Google Trends data showed that in the week of March 7-13, Google searches for the term NFT hit an all-time high, sending Google interest to the maximum of 100......

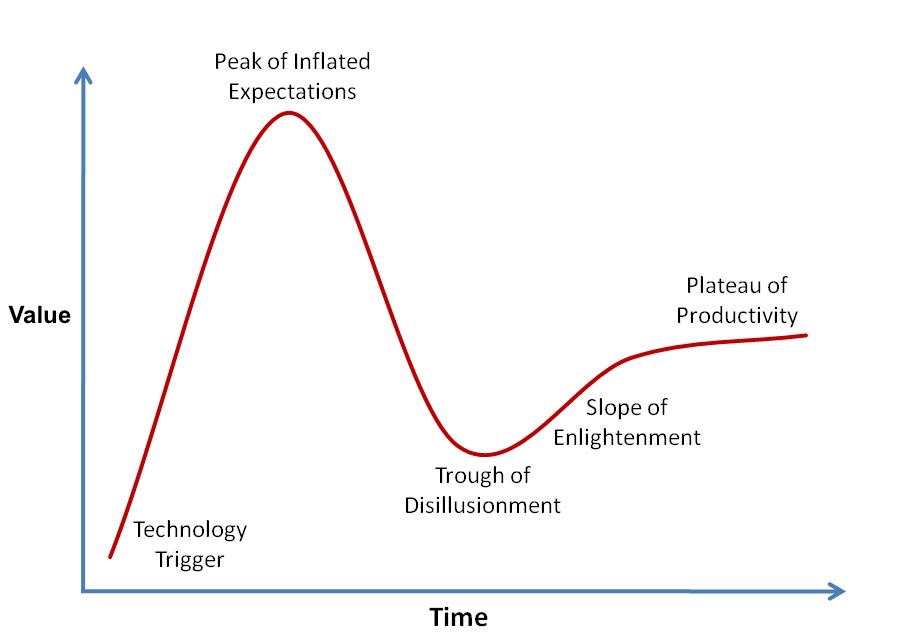

To some skeptical financial journalists and analysts, the eye-popping NFT is just another financial bubble after Bitcoin that was highly sought after by the US financial institutions and public companies at the beginning of the year, with prices reaching record highs and market capitalization surpassing \$1 trillion. However, if we acknowledge that a dynamic characteristic of money is to constantly search for the next investment target that combines technological innovation, paradigm shift, and a great story to maximize profits, NFT is likely to be such a new thing, one that is eye-catching, misunderstood, and controversial, especially now that it is basically at the peak of the hype revealed by Gartner's Hype Cycle that tracks technology maturity.

What is a NFT?#

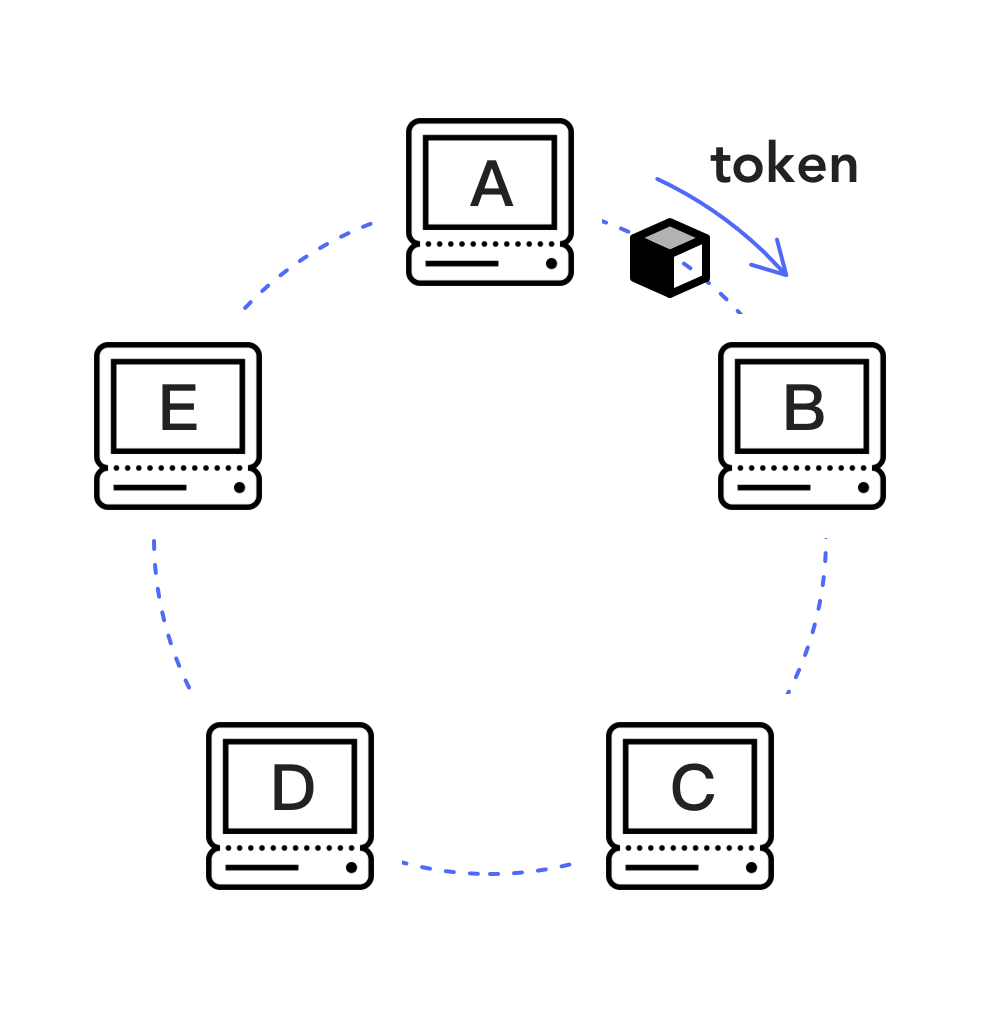

NFT stands for Non-Fungible Token. Token, before the computer era, was mostly a symbol of value and power, such as shells and other earliest currencies, a tiger-shaped tally issued to generals as imperial authorization for troop movement in ancient China. In the computer/communications field, Token originally referred to a data snippet used for specific purposes, such as the Token in the Token Ring of early network architecture, and the Token in articles on computer technology nowadays, including Session Token, Security Token, Access Token, JSON Web Token, CSRF Token, etc. (this Token is different from the Token in the blockchain field). Cryptocurrencies, represented by Bitcoin and Ethereum, are essentially digital Tokens that are well-known to us today following the advent of blockchains. With the support of the emerging technology, data becomes non-tamperable, verifiable, and traceable, which brings along the unique and non-tamperable value transfer of money and rights & interests in the digital world, making it open to all and no guarantee of third-party trust assessment required - just like cash transactions in the real world.

Let’s start with FTs, Fungible Tokens, before diving deep into NFTs. As the one-dollar coin in your pocket and a one-dollar bill in my wallet are equal in value and interchangeable, inarguably, the 6498 digital currencies can be traded on 437 crypto exchanges today are basically FTs, while NFTs are unique, non-interchangeable blockchain digital assets with different value attributes. To help understand NFTs, we will take the physical things in the real world as an example: the phone and the laptop you use every day, the chair you sit on, the house you live in, the car you drive, and any second-hand goods listed for sale on Craiglist, are all non-fungible assets because each of them is unique.

To get more knowledge on Tokens, you can read a chapter in Blockchain in Action: From Technology Innovation to Business Models, co-authored by us and published by CITIC Press Group in 2020, which provides in-depth coverage of the basics in simple language.

NFTs are all about digital ownership#

Following this logic, we may figure out the essence of NFTs. In a nutshell, NFTs are all about digital ownership, which ensures that assets are unique, scarce, and tradable in the digital world as they are in the real world.

Before Bitcoin, we had fungible digital currencies or non-fungible digital assets on Internet platforms, such as Tencent Q Coins, Alipay points, game props, and skins. But these assets obtained in exchange for money, time, and effort do not really belong to the users, for transactions are restricted, and the platforms can wield absolute power, arbitrarily revise rules anytime, leaving no room for argument. Vitalik Buterin, the founder of Ethereum, was inspired to create the blockchain platform, on which most NFTs are minted and operated today, by Blizzard canceled his favorite character's assets with system updates.

The success of Bitcoin in the past twelve years has enabled individuals to control assets independently without permission for the first time in the digital world, and the blockchain platforms leaded by Ethereum have been developed and popularized in the past five years, making individual’s digital ownership that can be confirmed, traded and circulated through DeFi and NFTs.

Thanks to the support of blockchain technology, NFTs boast the properties of invariance, verifiability, scarcity, standardization, interchangeability, tradability, liquidity, and programmability that physical assets and centralized digital assets do not have, which not only overcomes the general shortcomings of assets in the real world, such as high cost, low efficiency, being easy to tamper with or forge in preservation, authentication, circulation, and trading. Taking digital arts, the most popular category in NFTs right now, as an example, forgeries and frauds are common in traditional art trading. According to statistics, the art forgeries and frauds’ “market” value accounted for as high as 10% of the turnover. More importantly, assets in the digital world will far exceed those in the real world in terms of the variety of types and kinds, the speed and scope of trading, and circulating.

In the Internet era, the protection and circulation of music copyright have always been a challenge. With NFT technology for music authorization, you would only need to buy one NFT of music to legally enjoy it with different music service providers, unlike today when you may be forced to purchase music from each of them, such as Apple Music, Spotify, NetEase Cloud Music, QQ Music, and so on. Likewise, it is a thorny issue at present to use the music you paid for as a soundtrack to your content on your website, podcast, or video. However, using NFT authorization with smart contracts will make it easy and flexible in the future to avoid the intermediary mechanism and allow all kinds of authorized uses and revenue distribution. This is just an example of music, the same mechanism can be applied to video, photo, image design, and article content, etc., and NFT application scenarios are extensive.

A Brief Story of NFTs#

Flavien Charlon (left), ArcBlock Chief Scientist and Colored Coin pioneer, and Robert Mao (right), ArcBlock Founder, in Paris on New Year's Day of 2018

>

Robert Mao and Flavien Charlon were colleagues and working partners at Microsoft Research Europe. Flavion was involved in the earliest blockchain technology development and innovation, driving the Colored Coin technology; and is the founder of CoinPrism, the most influential company in Colored Coin implementation. He recalls, "I first heard about Colored Coin at the Bitcoin 2013 conference and immediately considered using it for interesting purposes. At the time, Colored Coin was just a concept. While the community discussed it, there was no concrete and viable implementation. Then I decided it was time to develop a standard Open Assets Protocol for Colored Coin, and we launched the Coinprism project and the Openchain project to allow individuals and businesses alike to color their Bitcoins.”

Rome wasn't built in one day, and neither were NFTs. NFTs’ history dates back to 2013 and Colored Coin’s attempt to allow people to color Bitcoin’s small units, by defining the data format in spare fields to represent various assets other than Bitcoins, such as coupons, digital collectibles, and asset certificates. However, due to the limitations of the Bitcoin blockchain architecture and the opposition from Bitcoin’s core development team, the Colored Coin experiment ultimately failed. Nevertheless, the creation of Colored Coin opened the door and laid the groundwork for further experiments with NFTs by making many people aware of the huge potential of issuing assets on the blockchain.

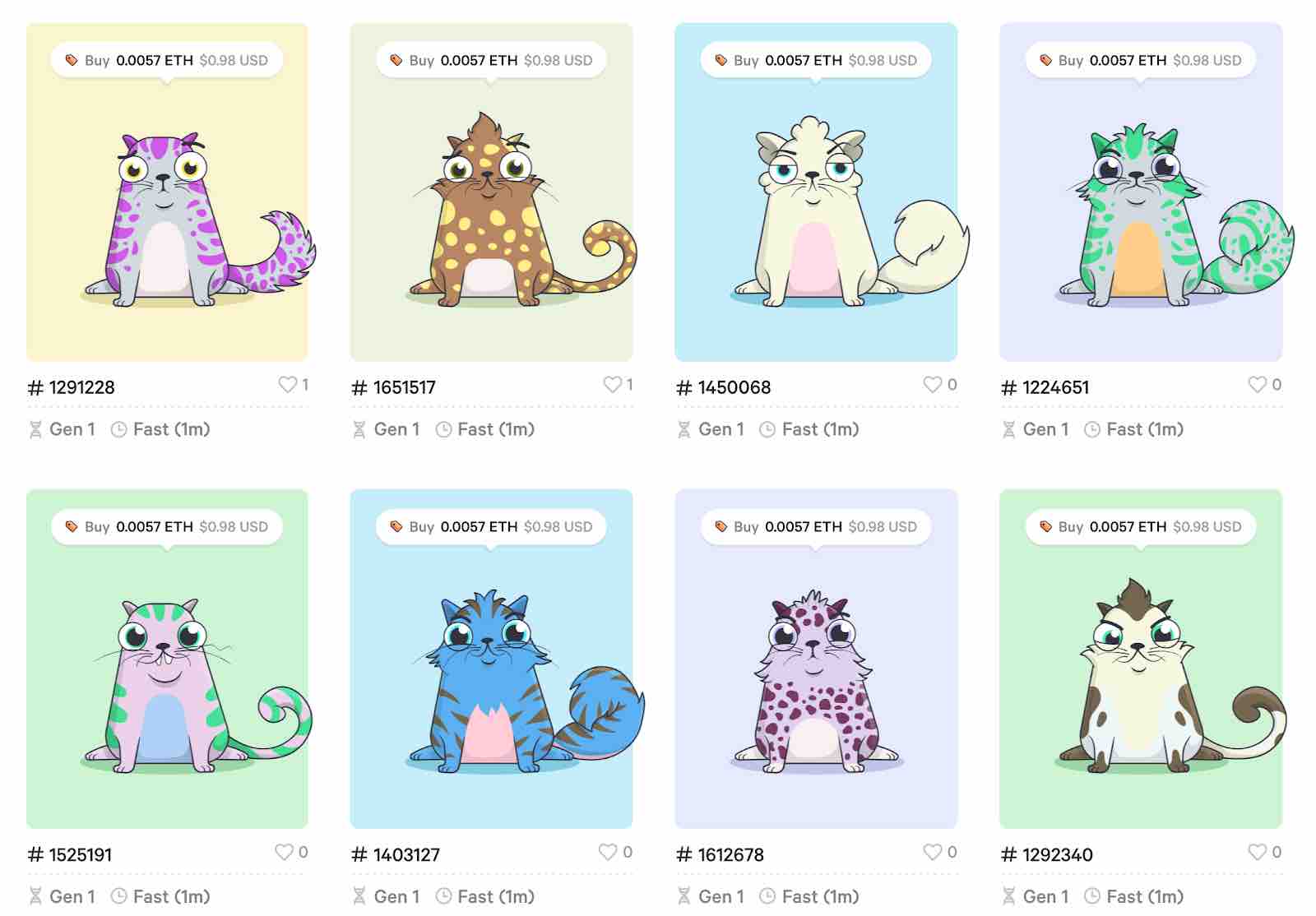

CryptoKitties, which was unveiled at Ethereum Waterloo Hackathon at the end of 2017, first brought NFTs into the mainstream. CryptoKitties is a blockchain game that allows players to adopt, breed, and trade virtual cats. The development team used Ethereum smart contracts to build a chain breeding algorithm in the game to determine the cat's genetic code, ensuring the "breeding” is random and predictable through a sound incentive mechanism; and introduced smart contracts for Dutch auction to inspire people to buy and trade cats for profits. The emergence of CryptoKitties coincided with the last cryptocurrency bull market in 2017, which fueled the game’s popularity. At the time, people’s purchasing, breeding, and trading frenzy of CryptoKitties led to the first serious congestion on the Ethereum network. The CryptoKitties sensation also helped establish ERC721 as the technical standard for NFTs on the Ethereum platform. ERC721 allows the blockchain to identify an NFT by tracking the ownership and transfer of each Token in a block. The CryptoKitties development team was well aware of the limitations of the slow throughput and expensive Gas fee of the Ethereum platform, so they set up a company, Dapper Labs, to raise venture capital from top funds such as a16z and USV, and then dove into the development of the Flow blockchain for NFT applications. Finally, they launched NBA Top Shot, the killer app for NFTs with the highest number of users and sales volume in the industry when the market turned bullish from the end of 2020 to the beginning of 2021.

In addition to digital artwork and digital collectibles, NFTs have been used in a broader range of applications. The NFT tickets issued by ArcBlock at our [first DevCon](<(https://devcon.arcblock.io/)>) in June 2020 and the NFT badges received by attendees at check-in expanded the application scenarios from games, artworks and collectibles to conference events and education and training, and introduced DID (Decentralized Identity) and VC (Verifiable Credentials) technologies into the NFT implementation standard, which made up for the shortcomings of ERC721, ERC1155 and other NFT standards that were too simple and insufficient in functions, and gained applause from users and attention from the industry.

Welcome to the Brave New World of NFTs#

The rise of NFTs in this bull market in 2021 is attributable to the maturity of blockchain technology, which sets up the stage for NFTs development standards, infrastructure, and market trading, and leads the application of NFTs to a break-out success first seen in categories such as art, collectibles, games, domain names, virtual worlds and so on. This shows the entertainment and content industry with the highest flexibility in adapting to the digital world is the best test bed for ownership digitalization experiment through NFTs, and they can promote it to the general public in the most easily understood way. Their track record of taking the lead in penetrating the market and disrupting the traditional media content industry amid the rise of the Internet is a testament to the capability.

In practice, NFTs’ agility in regulatory compliance gives them an advantage over FTs. Because cryptocurrencies are highly similar to securities, their development has been seriously constrained by the strict legislative regulation and slow legislative process in Europe and the US over the years, while NFTs have more flexible room for compliance. But today's NFTs boom reaches to the extent that some in the industry describe it as a "mania”, which owes much to the global pandemic that has caused currency over-supply, and excess liquidity in countries around the world, the steep acceleration of telecommuting and virtualization in work and life, and the increasing number of young people in Europe and the US who are bored at home due to the lock-down joining the investors. These strong driving forces behind the popularity of digital assets, such as Bitcoin, Dogecoin, and NFTs, cannot be underestimated.

However, NFTs’ application scenarios go far beyond today's eye-catching media products like crypto artworks and trading cards that fetch sky-high prices, and all kinds of assets and rights & interests in the real world can be mapped and tokenized through NFTs, and thus the digital world will witness a huge array of new assets to land in the market via NFTs going forward. In a word, everything can be NFTs.

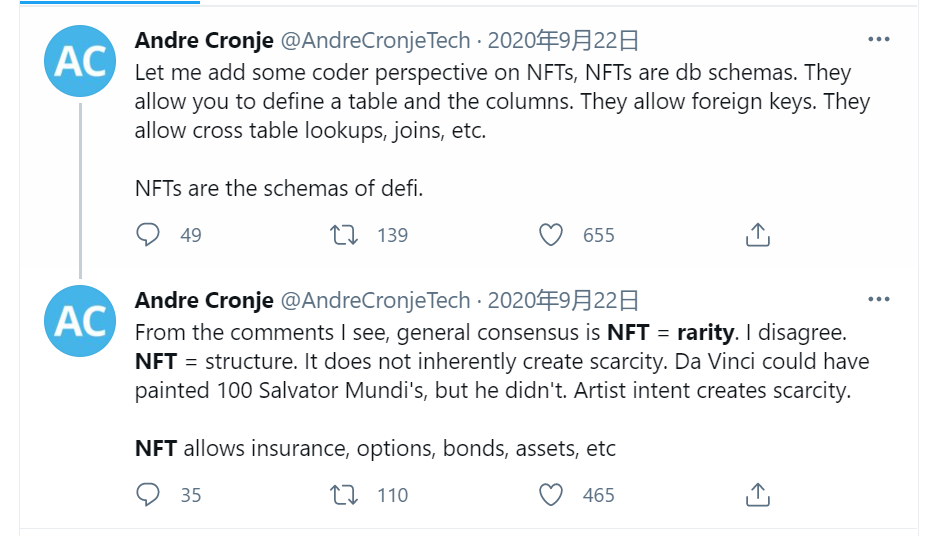

As the world speeds up in virtualization and digitization, it may be closer to the essence to look at NFTs from a programmer's perspective. As the DeFi innovator and YFI founder Andre Cronje says, NFTs are database schemas. They allow you to define a table and columns. They allow foreign keys. They allow cross table lookups, joins, etc. NFTs don't inherently create scarcity but define it. They can also define the various architectures of DeFi, so insurance, options, bonds, fixed assets, and other traditional financial products are all NFTs.

In addition, NFTs and FTs can be combined, such as using FTs to infinitely divide the rights and interests of NFTs, or including a certain amount of FTs through NFTs to create options, value certificates, and other more complex digital assets, and with a multi-level nesting. For example, in the newly released V3 product design of Uniswap, the leading decentralized exchange, to improve capital efficiency, the Liquidity Provider can provide liquidity for fund pools in different price ranges, so the credentials obtained (LP Tokens) change from ERC20 Tokens to NFTs. Because the positions are different, each position is an NFT.

Now that there are no unanimously recognized standards in place on NETs, the vast majority of NFT applications are currently using Ethereum ERC721 and ERC1155. These standards only define how to find the ownership of assets and how the on-chain circulation works. They do not consider how to read, store, and verify the off-chain data. Therefore, many encrypted artwork NFTs, with their multimedia files stored on centralized servers, unencrypted and unverifiable, can be easily downloaded and copied and uploaded to other places to generate new NFTs, causing disputes over who owns them.

Since 2018, ArcBlock has been deeply exploring and experimenting with the application of NFTs. In ArcBlock's NFT solution design, NFTs contain both resources and smart contract-like logic. ArcBlock even combines DID (decentralized identity) and VC (verifiable certificate) technologies with NFTs design implementation to solve the above-mentioned challenge of off-chain verifiable data, enabling any resources, such as tickets, certificates, badges, service computing resources, and so on, to be modeled and designed with NFTs, simplifying all kinds of complex resource allocation, transfer, and trading in the real world into asset transfer and trading on chain, creating significantly elegant and standardized solutions. With the ABT Node for decentralized deployment and Blocklets for infinitely scalable combinations, NFTs developed by the ArcBlock platform can support an extremely broad range of application scenarios. Supporting Ethereum's Optimistic Rollup technology, NFTs implemented with ArcBlock technology are fully compatible with the ERC721 specification, while offering performance and cost advantages unmatched by Ethereum.

NFT's surge in popularity in crypto art and digital collectibles is just the beginning of the great experiment with digital ownership. In a way, it is still difficult to operate NFTs with utility value on Ethereum due to its performance and Gas fees. The platform is more suitable for NFTs with a lower frequency of use, fewer interactions, and simpler application logic, like digital collectibles. To give full play to the NFTs’ advantages, a better performing system and mature Layer 2 technology will be required. By then, NFTs will help unleash the massive untapped potential of blockchain technology by expanding its application scenarios from just being a digital currency and financial assets. The new world built on NFTs and blockchains with applications of digital ownership in full swing is beckoning us to embrace.